Bank cards may be a terrific way to borrow money speedily and simply, providing you can pay back the balance in whole each month.

Prepaid debit cards allow for end users to load funds onto them instead of borrowing from their line of credit like standard plastic; these kinds generally come with decrease service fees but lack options including fraud defense and benefits applications found on typical difficulty types.

? Our A.I. Algorithm has calculated your odds to get a present today in a Outstanding ... 0% Make sure you present the final four digits of your respective SSN: There is a superior likelihood We have now your file in just our lending network.

Launching your military services job? We now have your back. Our Job Kickoff Loans are suitable for juniors and seniors at U.S. navy support academies or those attending selected officer schooling programs. With terrific fees that may make month-to-month payments more inexpensive, You need to use cash to:

Bankrate’s editorial group writes on behalf of YOU – the reader. Our intention is always to supply you with the best tips to help you make wise particular finance conclusions. We follow stringent suggestions making sure that our editorial content isn't influenced by advertisers.

It is determined by your money circumstance. A money-borrowing application could make economical sense If the credit score is lower and You merely should borrow a small amount while in the short-term.

The gives that surface on This page are from providers that compensate us. This payment may perhaps impression how and wherever products and solutions appear on this site, which include, one example is, the order wherein They could look within the listing categories, apart from exactly where prohibited by law for our home finance loan, home fairness here and other residence lending solutions.

Credit card cash innovations is often high-priced. They generally include a higher APR than a traditional cost, and also you might have to pay for a charge. Desire also starts accruing the moment you go ahead and take advance.

Our editorial workforce receives no immediate compensation from advertisers, and our written content is carefully truth-checked to ensure accuracy. So, whether or not you’re examining an article or an evaluation, you are able to belief that you just’re having credible and dependable information and facts.

Peer-to-peer lending platforms are in which persons lend money on to on their own as opposed to under-going banks.

Before implementing for your financial loan, ensure that you fully grasp the phrases of repayment and interest rates affiliated with it.

Not surprisingly, very little is definite considering the fact that Just about every submission is considered with a scenario-by-case basis. The proportion moves down substantially When you have submitted more than the moment inside the earlier 30 times. Requested Financial loan Sum Disclosure You may well be offered by using a personal loan volume from our Community Associate that's bigger or reduced than your asked for financial loan amount. Ai Increased Chance The share shown is decided by a mix of elements, such as although not restricted to, time and day of submission, offered lenders or presents, the frequency of one's requests, and For anyone who is a primary-time applicant. Needless to say, very little is definite because Just about every submission is taken into account with a case-by-case foundation. AI designs are integrated in raising this share. The percentage moves down considerably In case you have submitted in excess of at the time in the earlier thirty days. Checking for Offered Lenders while in the Network! This could only have a several seconds

The best way to read the doc checklist: The doc checklist represents the paperwork that may be wanted from you in the course of the applying method. In this checklist, you will notice “Bundled” and “Not applicable” columns.

Disclaimer: Not many of the files in this checklist will be relevant to your situation. If you are unclear about some of the documents described in our checklist, please arrive at out to us.

Josh Saviano Then & Now!

Josh Saviano Then & Now! Gia Lopez Then & Now!

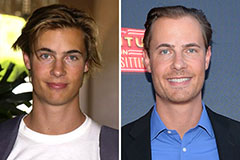

Gia Lopez Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!